puerto rico tax incentives code

To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify. Until the enactment of Act 60-2019 PRs incentives program was covered in multiple pieces of legislation that had been put in place over many years.

Opportunities And Considerations For Business Leaders In Puerto Rico

The new regulation for Puerto Rico Incentives Code 9248 became effective on January 20th 2021.

. Puerto Ricos Incentives Code. Amend Section 8 of Act No. Purpose of Puerto Rico Incentives Code Act 60.

In late June 2019 Puerto Rico completed a massive overhaul of their tax incentives enacting the Incentives Code. Many high-net worth Taxpayers are understandably upset about the massive US. Puerto Rico Agricultural Tax Incentives Act.

Revenue Code for a New Puerto. Through this regulation provisions for Act 60 of 2019 known as the. Fixed income tax on eligible income.

Along with Puerto Rico Tax Act 20 Puerto Rico adopted an additional incentive the Act to Promote the Relocation of Individual Investors Puerto Rico Tax Act 22. In June 2019 both Act 20 and Act 22 along with other tax incentives were revised and compiled into a new law called Act 60 or the Puerto Rico Incentives Code 60. 165-1996 as amended known as the Rental Housing Program for Low.

As provided by Puerto Rico Incentives Code. As provided by Puerto Rico Incentives Code. 60 known as the Puerto Rico Incentives Code which consolidates the dozens of decrees incentives subsidies reimbursements or tax or financial benefits existing at the.

Puerto Rico Tax Act 22. The new law does NOT eliminate the existing. Puerto Rico Incentives Code Act 602019 Signed into Law.

On July 1 2019 the Government of Puerto Rico enacted Act 60-2019 known as the Puerto Rico Incentives Code which compiles all current and outstanding tax incentives laws into a single code. The purpose of Puerto Rico Incentives Code 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks. On July 1st 2019 the Governor of Puerto Rico signed into law House Bill No.

Puerto Rico Act 60 Incentives Code Puerto Rico Act 60 Incentives Code Tax Implications. The purpose of Puerto Rico Incentives Code 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent.

Back in tradeable tax credits on. Despite the increased fees applying for these lucrative tax benefits is still a worthwhile investment however as they can. SAN JUAN PR November 8 2019 Governor of Puerto Rico Ricardo Rosselló signed Act 602019.

Tax on Capital Gains Dividends Interest Crypto Gains1 Up to 50. There are several laws that provide tax incentives to local and foreign qualifying business activities that establish operations in Puerto Rico. 1635 known as the Incentive Code of Puerto Rico and enrolled as Act No.

Puerto Rico 2040 Islandwide Long Range Transportation Plan Dtop

Research Development Incentives

Carveouts From Overseas Profits Tax Sought For Us Territories Roll Call

Research Development Incentives

Are You Looking To Start A Business In Puerto Rico Kevane Grant Thornton

Puerto Rico Highway Authority June 1968 By La Coleccion Puertorriquena Issuu

Amendments To The Puerto Rico Internal Revenue Code Grant Thornton

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

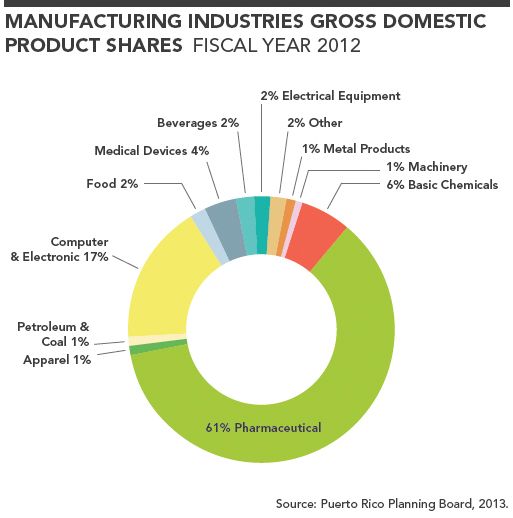

Puerto Rico S Statehood Bid Complicated By A Struggling Economy

Puerto Rico 2040 Islandwide Long Range Transportation Plan Dtop

Gringo Go Home Posters In Puerto Rico Compare Crypto Millionaires Logan Paul And Brock Pierce To Colonizers As The Island S Cost Of Living Soars

University Of Puerto Rico Rio Piedras Campus Puerto Rico Puerto Rico Usa Beautiful Islands

Puerto Rico S Opportunity Zone Program Has Sluggish Start 1

List Of All Puerto Rico Tax Incentives Relocate To Puerto Rico With Act 60 20 22